Small businesses are the lifeblood of communities across America, and there’s no doubt that restaurants account for a huge part of that. Right now, small businesses, and restaurants, especially, are hurting due to COVID-19. We’ve fielded all kinds of questions from operators who aren’t sure where they can find financial relief for restaurants amidst the pandemic.

On March 27th, 2020, the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), was signed into law. This act includes the Payment Protection Program (PPP), which will provide loans to assist small businesses to counteract the challenges caused by the Coronavirus pandemic.

Application submissions for the Payment Protection Program opened on April 3rd, and applicants have until June 30th, 2020 to submit. However, loans are distributed on a first-come, first-serve basis, so make this a top priority if you’re in need.

Below, we’ve outlined where to start, what to expect, how to prepare and more.

Start with your network

First things first, if you have a relationship banker, look to them as your primary resource for questions and guidance. They’ll be able to provide you with next steps that are specific to you and your business.

Check your eligibility

According to the U.S. Small Business Administration, the following entities affected by Coronavirus (COVID-19) may be eligible for the Payment Protection Program:

- Any small business concern that meets SBA’s size standards (either the industry based sized standard or the alternative size standard)

- Any business, 501(c)(3) non-profit organization, 501(c)(19) veterans organization, or Tribal business concern (sec. 31(b)(2)(C) of the Small Business Act) with the greater of:

- 500 employees, or

- That meets the SBA industry size standard if more than 500

- Any business with a NAICS Code that begins with 72 (Accommodations and Food Services) that has more than one physical location and employs less than 500 per location

- Sole proprietors, independent contractors, and self-employed persons

Get your paperwork in order

After you’ve confirmed that your business is eligible to apply, start gathering the necessary documents you’ll need to have on hand in order to fill out the application. Our colleagues at Dvorak Law said at minimum, you should have these documents prepared prior to completing your form:

- Payroll tax reports filed with the Internal Revenue Service (including IRS forms 940, 941, 944 and state income and unemployment tax filing reports) for the entire year of 2019 and the first quarter of 2020 (if available).

- Payroll reports for each pay period for the preceding 12 months ending on your most recent payroll date, which should include gross wages including paid time off, vacation pay, family medical leave pay and state and local taxes assessed on an employer’s compensation.

- Documentation reflecting the health insurance premiums paid under a group health plan including the owners of the company for the immediately preceding 12 months prior to the date of the Paycheck Protection Program loan origination (copies of the monthly invoices should be sufficient).

- Documentation of all retirement plan funding, including work papers, schedules, and remittances to the retirement plan administrator, by the company for the preceding 12 months.

- Drivers licenses for each of the company’s owners.

- Organizational documents for the company (including articles/certificates of incorporation/organization, bylaws, operating agreements, etc.)

Keep in mind that this list isn’t exhaustive and your bank may have additional requirements in order to process your loan application.

Prepare to use your loan

The Payroll Protection Program loan can be applied toward:

- Payroll costs, including benefits;

- Interest on mortgage obligations, incurred before February 15, 2020;

- Rent, under lease agreements in force before February 15, 2020; and

- Utilities, for which service began before February 15, 2020.

Understand your payroll costs

Payroll costs include:

- Salary, wages, commissions, or tips (capped at $100,000 on an annualized basis for each employee);

- Employee benefits including costs for vacation, parental, family, medical, or sick leave; allowance for separation or dismissal; payments required for the provisions of group health care benefits including insurance premiums; and payment of any retirement benefit;

- State and local taxes assessed on compensation; and

- For a sole proprietor or independent contractor: wages, commissions, income, or net earnings from self- employment, capped at $100,000 on an annualized basis for each employee.

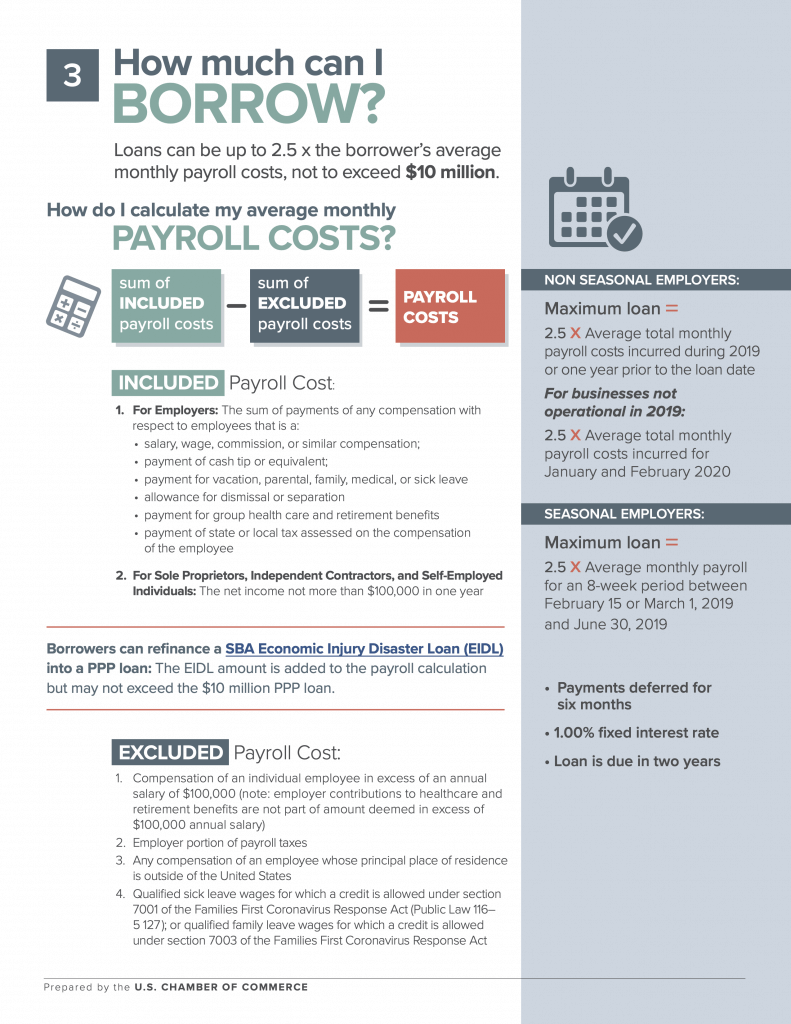

Evaluate your loan amount

For restaurants, this might be tricky to calculate, specifically if you hire seasonally. Loans can be for up to two months of your average monthly payroll costs from the last year plus an additional 25% of that amount. That amount is subject to a $10 million cap. If you’re a seasonal or new business, you will use different applicable time periods for your calculation. Payroll costs will be capped at $100,000 annualized for each employee.

Reach out to a lender

Getting your money will depend on your lender and their approval into the Payment Protection Program. Visit this link to find an approved lender.

Plan to utilize loan forgiveness

If you use the loan amount for anything other than payroll costs, mortgage interest, rent, and utility payments over the 8 weeks after getting the loan, you’ll owe money back. It’s anticipated that not more than 25% of the forgiven amount may be for non-payroll costs due to the expected high subscriptions. Keep in mind you will also owe money if you do not maintain your staff and payroll.

- Number of Staff: Your loan forgiveness will be reduced if you decrease your full-time employee headcount.

- Employee and compensation levels are maintained.

- Level of Payroll: Your loan forgiveness will be reduced if you decrease salaries and wages by more than 25% for any employee that made less than $100,000 annualized in 2019.

- Re-Hiring: You have until June 30, 2020 to restore your full-time employment and salary levels for any changes made between February 15, 2020 and April 26, 2020.

There are several factors to consider once loans are distributed, but your first priority should be getting your application in. Then, you can work with your lender to hash out the details. Additional FAQs provided by the U.S. Small Business Administration can be found at this link.

————————————————–